There isn't a clear answer on which bank is more trustworthy. Winner: Bank of Americaīoth banks pay low rates overall, but Bank of America does have some good rates on select terms, and it has more types of CDs to choose from. Meanwhile, Chase's only competitive rates are on 3-month, 6-month, and 12-month terms, and rates vary depending on where you live. There's also a Bank of America Flexible CD that pays a decent rate and doesn't charge early withdrawal penalties. It also has a Bank of America Featured CD that pays 0.05% to 4.70% (vary by location) on 7-month, 10-month, 13-month, 25-month, and 37-month CDs. Bank of America pays relatively high rates on 3-month, 4-month, and 5-month terms. You may prefer Chase if you don't qualify to waive monthly fees with either bank, though, because its fee is lower.īank of America CD rates and Chase CD rates are low for most terms, with a few exceptions. Bank of America also offers cash-back rewards at select retailers. Winner: Bank of Americaīank of America Advantage Savings waives your monthly fee for the first six months, and you can waive it until you turn 25 if you're a student.

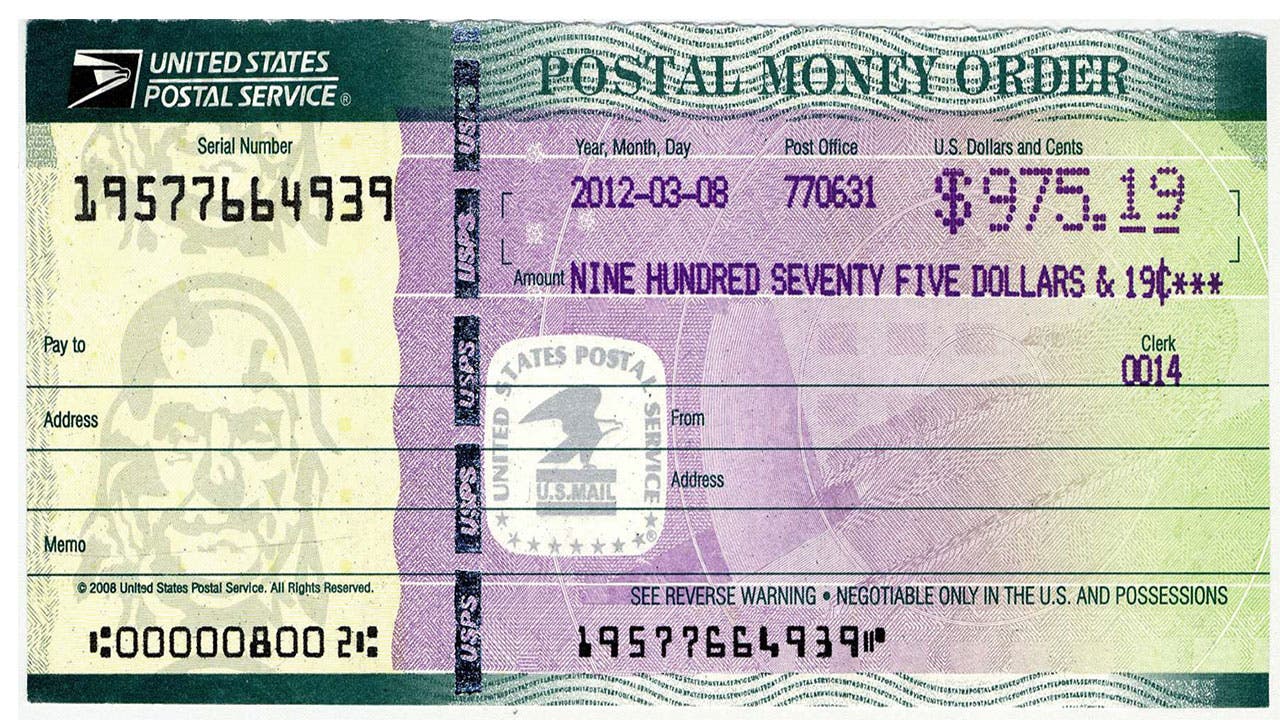

If you choose for cash to deposit into the savings account, this can be a good way to save extra money. You'll also select which Bank of America account you want the cash earned to go into. Through Bank of America online banking or the mobile app, you can select a cash-back deal that kicks in when you make a purchase with your debit card. You can earn significantly better rates online with the best high-yield savings accounts.īank of America's cash-back system does give it an advantage, though. $8 monthly fee is automatically waived for the first 6 monthsĬhase and Bank of America savings rates are low across the board.An account owner is a student and under the age of 25.Linked qualifying Bank of America checking account.Linked to qualifying Chase checking accounts.Linked Chase College Checking℠ account for overdraft protection.$25 or more in automatic transfers from Chase checking.*With Chase Overdraft Assist℠ - no overdraft fees if you're overdrawn by $50 or less at the end of the business day or if you're overdrawn by more than $50 and bring your account balance to overdrawn by $50 or less at the end of the next business day*.Chase Overdraft Assist℠ - no overdraft fee if you're overdrawn by $50 or less at the end of the business day or if you're overdrawn by more than $50 and bring your account balance to overdrawn by $50 or less at the end of the next business day*.

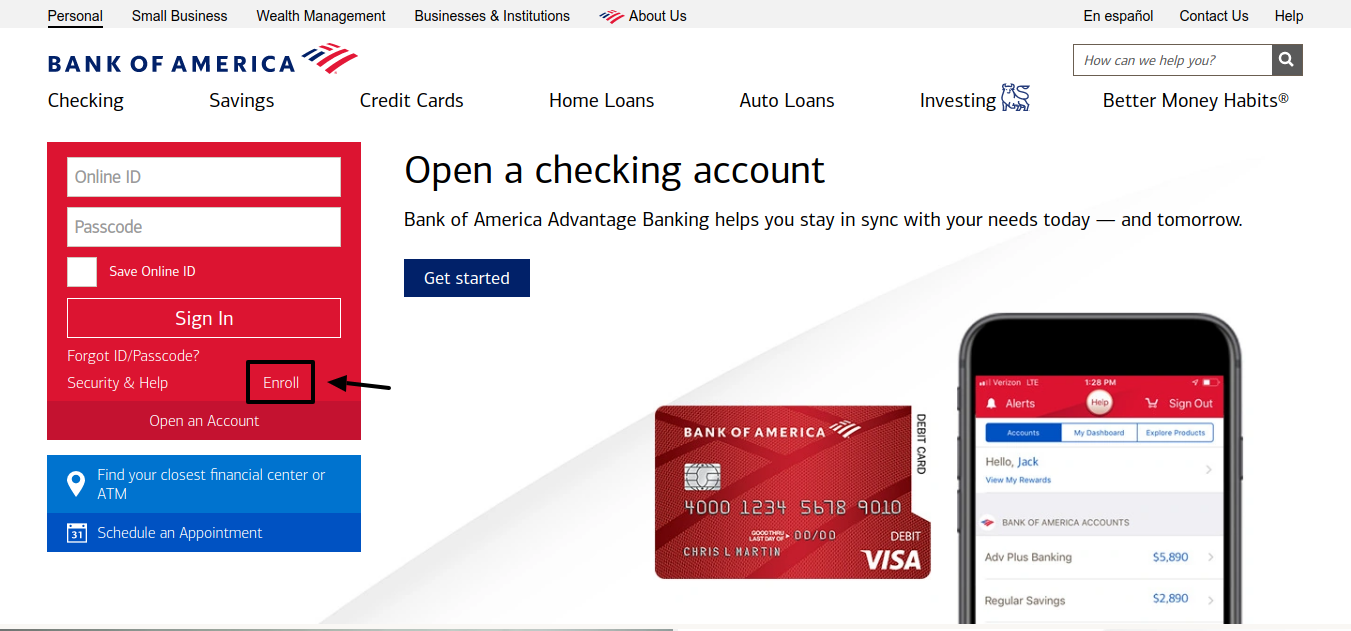

New Chase checking customers enjoy a $200 bonus when you open a Chase Total Checking® account and set up direct deposit.See the best bank account bonuses right now »Ĭompare Today's Banking Offers Winner: ChaseĬhase's higher sign-up bonus and no minimum deposit give it an edge over Bank of America - although Bank of America makes it a little easier to waive the $12 monthly service fee. To get Bank of America's bonus, receive $1,000 in direct deposits in the first 90 days. To earn the $200 bonus with Chase, you need to set up direct deposits within 90 days of opening the account. Your choice between the two could come down to whether you qualify to avoid the monthly fee. Enroll in the Preferred Rewards programīoth checking accounts charge a $12 monthly service fee, but it's possible to waive it with each bank.Maintain $5,000 average daily balance in all Chase accounts and linked investment accounts.

0 kommentar(er)

0 kommentar(er)